Robin Li Yanhong, founder and CEO of China’s largest search engine Baidu, said that China has too many large language models but too few practical applications. Yanhong made the remarks during a panel discussion at the recent World Artificial Intelligence Conference (WAIC) in Shanghai, reported the South China Morning Post.

“In 2023, there is fierce competition among more than 100 law master’s programs in China, leading to a huge waste of resources, especially computing power,” Li said. “I noticed that many people are still mainly focused on the basic model. But I want to ask: What about the real-world applications? Who has benefited from it?”

The World Intellectual Property Organization (WIPO) reported last Friday that China has outpaced the U.S. in AI patents by six to one over the past decade, but WIPO data also shows that China lags behind in citations, with only one Chinese institution, the Chinese Academy of Sciences, on the list of the top 20 institutions for research citations.

Any LLM open to the public in China must be approved by Chinese regulators, allowing the Chinese Communist Party (CCP) to effectively control Chinese citizens. As of March 2024, over 200 AI companies have applied for licenses, of which 117 have been approved by Beijing. With so many LLMs, everyone is fighting for a share of the pie, and not everyone can win. “We expect that in the future, there will be a lot of consolidation in the industry, and LLMs will be developed mainly by five companies,” said Yang Junjie, CEO of AI startup MiniMax.

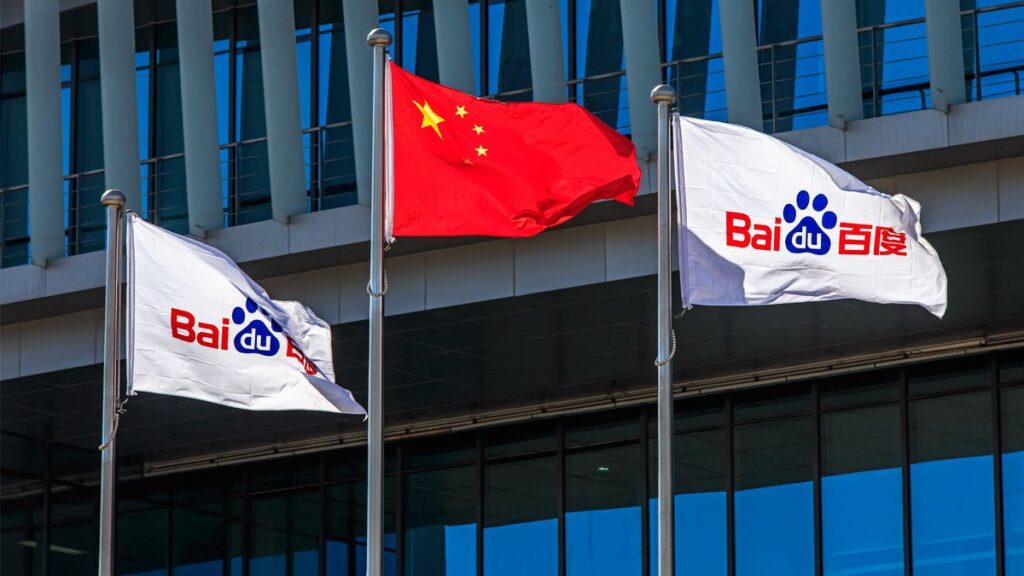

As OpenAI’s APIs will no longer be available in China from July 9, many large companies have started to move in to capture the market that the company will be leaving. Large technology companies Tencent, Baidu, and Alibaba have started offering discounts and plans to entice customers to buy their products, which may not be sustainable for small and medium-sized businesses.

Competition is good for any market, but too much choice can also lead to decision fatigue, as customers can become overwhelmed with so many similarly priced services. Big companies will likely win here because they have more financial power and can use it to buy out or kill smaller competitors. “I think the big language models will probably be a big mess, and there will be very few players left,” says Bernard Leong, CEO of Singapore-based Dorje AI.